Cenovus’ Acquisition of MEG Energy: Scale, Synergies, and Strategic Risk

Cenovus’ Sunrise oil facility northeast of Fort McMurray in 2023

On August 21st, 2025, Cenovus Energy (NYSE/TSX: CVE) reached an agreement to buy MEG Energy in an all cash and stock deal totaling $7.9B CAD, MEG shareholders were given a share value of $27.25, a 27.9% premium over their price at the time. To fund this acquisition, Cenovus took out a $2.7B loan, and acquired a separate $2.5B bridge loan – Cenovus plans to launch a senior debt offering to fund the bridge loan – but has not confirmed funding yet.

The deal will merge MEG’s major oil sands assets such as ones from the Christina Lake Project, with Cenovus’ existing footprint in Alberta. Together, total assets will combine to produce over 720,000 b/d (barrels per day of oil). Following the announced agreement, Cenovus remarked that the deal would “immediately be accretive” to their cash flow – the deal is expected to generate $150M of annual synergies in the near term, and climb to over $400M by 2028. Cenovus shares initially climbed 4% following the announcement. Key advisors included Goldman Sachs and CIBC Capital Markets for Cenovus, while BMO Capital Markets and RBC Capital Markets advised MEG's Special Committee. JP Morgan and CIBC Capital Markets provided debt financing for Cenovus.

Background

Prior to the deal (2017–2018), MEG Energy had been struggling, having spent the prior decade aggressively expanding on their Christina Lake oil sands project. The project drilled horizontal wells in parallel with each other – the top well injecting high pressure steam and the bottom well collecting heated bitumen (oil sands bitumen is too thick to flow at reservoir temperature, you can’t just drill a vertical well and pump the oil out). The steam heats the reservoir, reducing viscosity by roughly 100x, and then gravity drains the bitumen downwards through the bottom (producer) well.

This project required billions of dollars in up front capital, as oil sands are highly capital intensive. Furthermore, MEG opted to fund the project primarily with long term debt – which exceeded $4B in total, representing over 50% of their enterprise value at the time of acquisition. To make matters worse for the company, oil prices had fallen. The combination of falling oil prices and high debt burden and interest expense led to MEG having extremely weak cash flow, which, combined with their need for more capital to further fund the Christina Lake project, made them a prime takeover target.

Prior to Cenovus buying out MEG, Husky Energy had attempted a takeover of MEG (September 2018) – offering $6.4B in cash and shares. MEG rejected this bid, stating that Husky had grossly undervalued their company, and highlighting that their current state does not properly reflect their future recovery. Later that year (December 2018) Husky extended their deadline for MEG to accept the deal, but MEG shareholders were still not in support. In 2021, Husky Energy merged with Cenovus Energy. From then until 2024, there were no takeover attempts.

Deal Structure

The deal involved Cenovus acquiring 100% of MEG’s outstanding shares via a court-approved plan of arrangement under the Business Corporations Acts. MEG shareholders receive $27.25 per share. The deal is paid for all cash and stock – the ratio between cash and stock is not yet finalized but there have been hard caps announced of $5.2B max total cash paid and 84.3M max shares issued. The deal implies an EV of $7.9B. Following the deal, existing Cenovus shareholders still own 95.5% of the market cap, former MEG shareholders now own 4.5% collectively.

A termination fee of $242M payable for MEG applies should they accept a superior proposal or change their board recommendation before the deal is finalized. As well, an equal $242M payable applies to Cenovus should antitrust approvals not be obtained.

In order to be fully finalized, the deal still needs ⅔ of shareholder approvals at a special MEG meeting, as well as the Court of King’s Bench of Alberta approval, Competition Act clearance, and TSX and NYSE listing approvals for Cenovus shares. There has been no financing condition needed to close the deal. Cenovus has financed the deal with primarily debt, provided by both CIBC and JP Morgan.

Strategic Rationale

This move allows Cenovus to deepen their position and hopefully better defend themselves against cost exposure in uncertain times (environmental, regulatory, investor sentiment). Furthermore, it is likely that the prior bid by Strathcona Resources (another large Canadian oil producer) piqued the interest of Cenovus in MEG as a takeover target. Furthermore, Cenovus cash flow will likely improve as a product of the acquisition in the long term. From the perspective of MEG Energy, they were bailed out in a time of extreme uncertainty with their high debt and weak cash flows, and were compensated favorably given their financial position.

Implications & Potential Risk

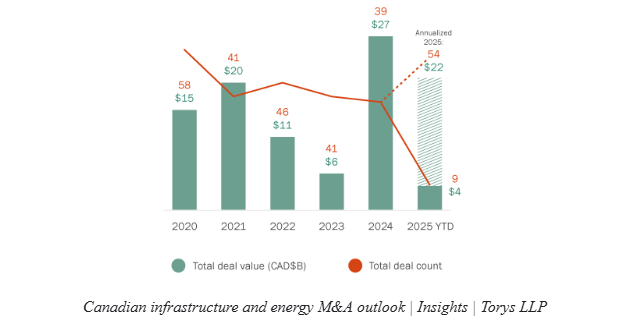

This deal will heavily impact Cenovus’ balance sheet, capital structure, and integration risk. Furthermore, the deal adds to the theme of Canadian resource sector consolidation due to cost of capital, stringent emissions rules, and long regulatory timelines. Large cap resource transactions such as this deal reinforce that although overall deal volume in Canada has not fully recovered from its 2021–2022 peak, strategic buyers with strong balance sheets are still prepared to deploy capital when assets fit and operational synergies are clear. Furthermore, this deal is reflective of the overall Canadian M&A market – with deals often consisting of competing bids, and limited credible buyers.

Potential risks for this deal include the financing risk if crude price weakens, regulatory overviews, and ESG expectations. Crude price weakening would tie up their cash flow, increasing their leverage ratio and cost of capital and leading to a lower collateral for secured debt. Regulatory overviews such as the Provincial review by Alberta Energy Regulator (AER) must be formally approved for the deal to be finalized, possibly imposing delays as the Canadian resources market is quite regulated. Finally, since MEG is solely focused on SAGD oil sands production, and the resource market is facing increased scrutiny from pension funds, increased emissions and their climate change risk could lead to a low ESG score and therefore higher cost of capital (pension fund policy disclosures).

Conclusion

Overall, Cenovus Energy’s acquisition of MEG Energy represents a strategically timed consolidation that strengthens Cenovus’ oil sands footprint, enhances long-term cash flow, and unlocks meaningful synergies, at the cost of higher near-term leverage and integration risk. The transaction reflects a broader trend in Canada’s resource sector: disciplined strategic buyers remain willing to deploy capital where scale, asset quality, and operational synergies justify the risk.