The War in Ukraine: Economic Effects on a Global Scale

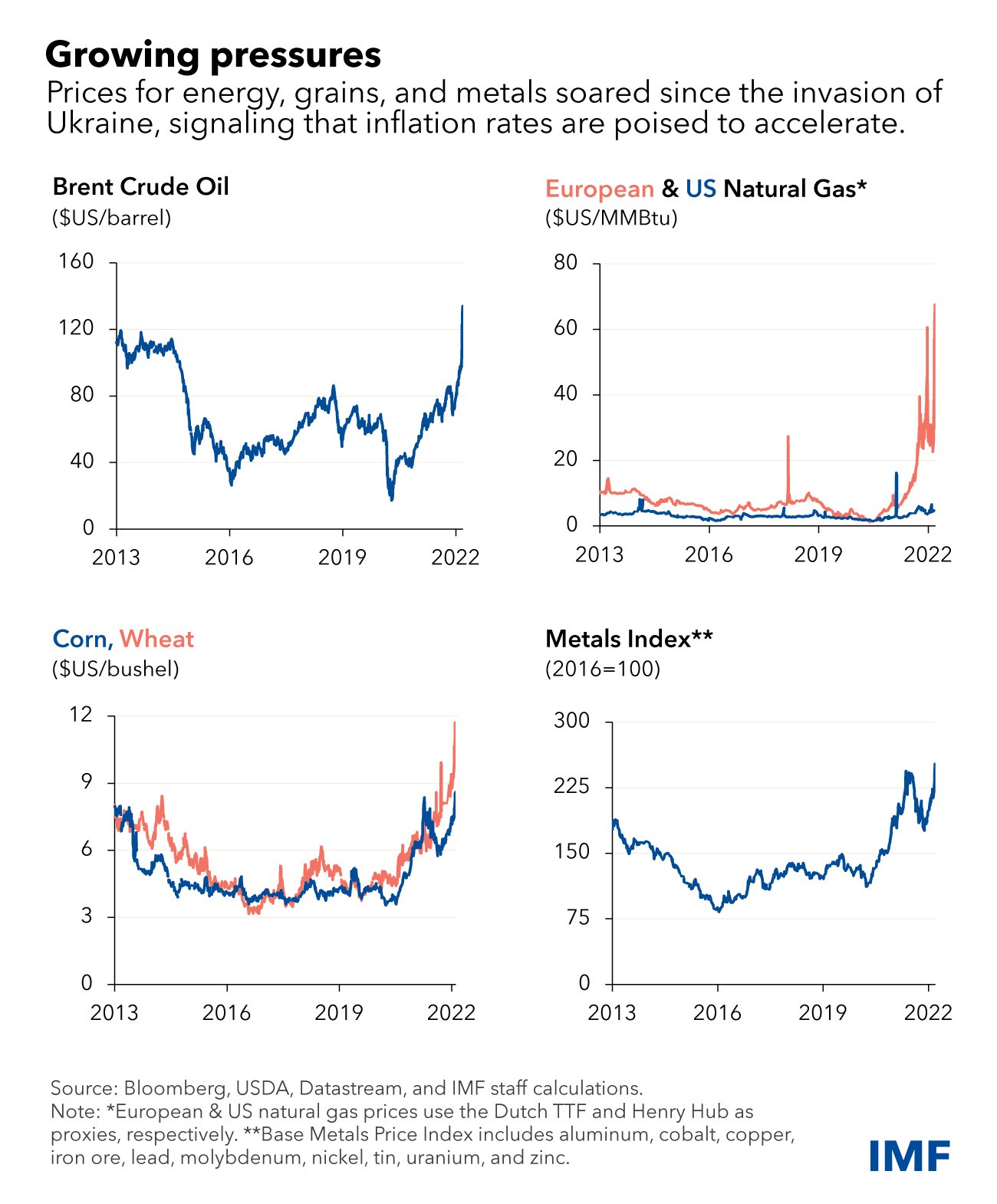

Since Russia’s invasion of Ukraine on February 24th, 2022, global trade and logistics have been deeply altered. Western sanctions have severely impacted world economies, particularly Russia’s. The war’s negative economic effects are not limited to the two belligerents, or even Eastern Europe; shocks to the commodities markets for oil, natural gas, wheat, and certain metals have substantially debilitated the global economy.

Due to Western sanctions, and their reduction of Russian production, the price of natural gas and coal have increased by 127% and 96%, respectively, in the six months following the invasion. Moreover, the destruction of one-third of Ukraine’s agricultural land has led to a tightening of the global supply of wheat. Several agricultural-exporting states have also exacerbated this threat. For instance, India has banned wheat exports to guarantee its food security, constraining the global wheat supply even further. These shocks, exacerbated by government reactions, have given rise to some of the largest price increases in the last century. Price increases of this magnitude in the market for wheat have not been experienced since the Dust Bowls of the 30s or the Russian Grain Deal of the 70s. Furthermore, a lack of inventory in both oil and wheat means many nations are not well prepared to absorb the supply shocks. In effect, entering into 2022, world inventories of both wheat and oil were 10% below the five-year average.

Commodity supply shocks have been substantial, impacting the economic activity of most nations. For instance, the shortage of gas or oil supply have contributed to the corresponding large increases in inflation. The effects on the global economy have been further exacerbated by hawkish central bank policies as central banks are “determined to crush the inflation spiraling energy costs are fueling”, despite the fact that higher interest rates will lead to lower consumption for households and lower investment from companies struggling with rising costs. Rising energy costs, along with an increased cost of borrowing, have led to lower-than-predicted GDP world growth for 2022 and 2023. As a result, as much as 2.8 trillion dollars will be lost worldwide in 2023.

The effects of the Russo-Ukrainian events have been felt unequally across world nations. Europe’s reliance on Russian natural gas (comprising 40% of Europe’s gas supply), has caused the economy to suffer disproportionately. Moreover, European equity markets, especially those in countries closest to the conflict, have experienced disproportionately negative effects due to a geopolitical risk premium. ECB states estimate that 20% of the equity market cross-country variance could be explained through nation proximity to the conflict.

According to the Organisation for Economic Co-operation and Development’s report (OECD), the GDP growth in the Eurozone in 2023 will be as low as 0.3%, while in 2022, GDP growth is predicted to be 3.2%. Due to such a significant drop in the GDP, and high inflation, the Eurozone will enter a recession in 2023. As unemployment seems below its natural rate, wages will eventually start to increase (as in the United States), leading to even higher inflation rates. Considering the energy crisis that Europe is facing alongside inflationary pressures, it would be reasonable to suggest that these disruptive effects will cause a slow recovery in the Eurozone economy.

Similarly, US GDP growth will drop from 1.5% in 2022 to only 0.5% in 2023; Canada may fare better as its GDP growth is predicted to drop from 3.4% to 1.5%. The reason for this significant discrepancy between North America and Europe is the dependence on Russian oil. For instance, the US relies mostly on Canadian as well as Mexican oil. Therefore, even though its production is suffering from supply chain disruptions caused by the energy crisis in the rest of the world, the energy supply shortage impacts the US economy to a much lesser extent than the European economy. As a result, although the US will also enter a recession in 2023, its economy is expected to recover by 2024.

Furthermore, the conflict has also had a tragic impact on the growth of low-income economies, as Ukraine and Russia are substantial exporters of wheat and sunflower oil, which are critical products for the food supply of many emerging economies. Such dramatic shortages in food supply may cause famine, which in turn, will lead to even lower economic growth and greater suffering overall.

Beyond its localized impact, Russia’s invasion of Ukraine has caused a domino effect which will have lasting consequences on the global economy. The EU, alongside emerging nations, will bear the brunt of these negative effects. However, high inflation and rising interest rates indicate significant future impacts on global markets. An imminent world recession and skyrocketing commodity prices are likely occurrences in 2023.