So, Is The World Economy Doomed or What?

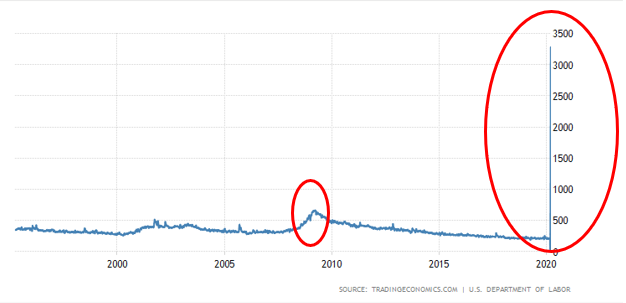

A lot of numbers have been thrown around, but what exactly can we expect, economically-speaking? Over 3 million unemployment claims were recorded last week in the U.S. This makes 2008 look like a walk in the park. The number in Canada was even more worrying – almost 1M unemployment claims were filled during the same week. For a country almost a ninth of the size of the U.S., that’s a lot. The good news is that, for now, these layoffs are mostly temporary. For example, Air Canada and Air Transat laid off 20,000 workers. As soon as travel restrictions are lifted, most of these workers should be able to find work.

Weekly unemployment claims in the U.S. (in thousands)

However, this is not to say that there won’t be a long-term effect on the economy – it’s just incredibly hard to forecast when this will all end. According to a McKinsey report, if the virus is contained in the next 2 to 3 months (scenario A3), the U.S. economy should go back to the previous pre-crisis state in the third quarter of 2020. If social distancing goes on for months (scenario A1), we would have to wait until the first quarter of 2023. That’s how sensitive the analysis is right now.

Source: Covid-19: Briefing Note, McKinsey, March 25th.

Governor Cuomo said it best – as soon as testing becomes widely available, people will be able to get back to work. No one knows when mass-testing will be possible. South Korea, for example, has been able to keep the country going by testing around 20,000 people per day. Because of its very quick response, South Korea was able to spot clusters, and limit the damage. However, the U.S.’ inability to react quickly has only made this harder.

The reality is: the current climate is so complex no one knows how this will pan out. Some wonder if it is even feasible to stay on lockdown for an extended period of time. In the U.S., almost 80% of the population lives paycheck to paycheck. The $2 trillion stimulus package might help, but is $1,200 enough for Americans to stay holed up at home for months?

The president of the Federal Reserve Bank of St. Louis, James Bullard, forecasted that the unemployment rate would hit 30%, with a decrease in GDP of 50%. It is important to note that these numbers were based on the assumption that no fiscal measures would be undertaken, which is not the case. The unemployment rate based on these numbers would fall between 10 and 40%. Goldman Sachs was a bit more “bullish”, forecasting a 24% drop in GDP. One key aspect of this recession is that it may be an extraordinarily bad one (the largest quarterly decline in GDP in recorded history was only around 10%), yet a very short one – James Bullard was also very confident that this dip would last only a few months, and that the economy would bounce back to its pre-crisis level very quickly.

The fact of the matter is, no one knows when we will be able to get back to normal. According to Adam Kucharski, epidemiologist at the London School of Hygiene & Tropical Medicine, the virus could circulate for a year or two, or until (and if) we find a vaccine for the COVID-19. Anyone who has dared to take a look at the Imperial College COVID-19 report will find it is extremely sobering. For one thing, we’re not even sure a vaccine is possible. According to Dr. Marc Lipsitch, professor of epidemiology at Harvard University, it is possible COVID-19 becomes a seasonal disease, and that cold and flu season becomes “cold and flu and COVID-19 season”.

There’s also a huge ethical dilemma at stake: how long are we willing to accept a “self-imposed” recession? After all, each percentage point increase in unemployment results in 40,000 people dying in the U.S. If you do the math, a 25% increase means 1 million people dead. Sure, it’s unclear whether or not this applies for short-term unemployment, but it is worth thinking about.

Another aspect of this crisis is its impact on emerging markets. The 2008 financial crisis hurt these economies, but the impact was mitigated by a strong response from China. For countries relying heavily on manufacturing, a long-lasting lockdown would be crushing. Add to the fact that a lot of these countries do not have a very efficient healthcare system, and the COVID-19 is a recipe for disaster. This would be felt in developed countries as well, as firms listed in the S&P 500 generated 44% of their sales outside the United States.

So, what’s the consensus?

Frankly, a lot is up in the air right now. We are going to go through a recession, but its impact is quite unclear. Some speculate that a full lockdown will buy us enough time to come up with wide-scale testing. If that happens, our suffering could be short-lived. If not, who’s to say how long this thing will last.

The saying still prevails, other than death and taxes, nothing is certain. Take everything with a grain of salt – no one really knows.